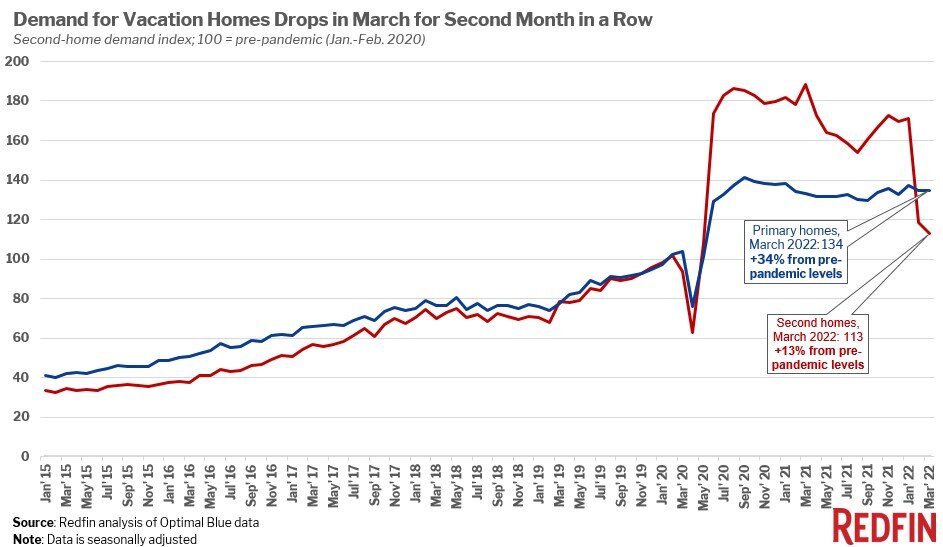

According to national residence broker Redfin, demand from customers for trip residences in the U.S. has dropped sharply for the next month in a row in March 2022, with property finance loan-price locks for next properties at their lowest level because Might 2020.

Demand for holiday households was however up 13% from pre-pandemic levels, but it can be declining just after a pandemic-fueled second-house boom past year. Still, Redfin expects demand from customers for second households to keep on being over pre-pandemic ranges in the potential, as remote function is below to remain for quite a few Individuals.

The slowdown in desire for getaway properties joins other early indicators that the traditionally quickly rise in mortgage loan prices and document-superior residence costs are pricing out some prospective buyers.

“The pandemic-driven surge in income of holiday vacation residences is coming to an close as home loan prices rise at their swiftest rate in historical past, producing some 2nd-property customers to back again off,” reported Redfin Deputy Chief Economist Taylor Marr. “When fees and costs shoot up so a great deal that a trip property begins to glimpse additional like a burden than a very good financial commitment and a fun put to deliver your family members on the weekends, a good deal of potential consumers have next thoughts. The new next-dwelling loan fees that kicked in on April 1 were being also a deterrent. As well as, some buyers’ down payments–and their nerves–most likely took a strike when the inventory marketplace dipped about the last number of months.”

Advancement in need for most important residences outpaced that of 2nd properties for the next month in a row, with property finance loan-rate locks for principal households up 34% from pre-pandemic stages. Desire for key residences has remained at about the exact same degree because June 2020.

Interest in getaway residences skyrocketed in mid-2020 as quite a few affluent Americans began doing work remotely and mortgage loan costs dropped to file lows, with mortgage loan-price locks for next residences reaching a peak of 88% over pre-pandemic ranges in March 2021. Demand from customers declined sharply around the past two months as mortgage loan premiums shot up at their speediest pace in historical past, achieving 4.67% by the close of March, and some staff started out returning to the office.

A further deterrent to demand from customers was the impending rise in personal loan charges for 2nd-home loans, which amplified by about 1% to 4% starting on April 1. The change provides about $13,500 to the price of buying a $400,000 property for the standard getaway-home buyer and will continue to interesting desire in family vacation houses in the coming months.

More Stories

Full guide to hotel room cleaning – SiteMinder

Minor rebrands Thai site to become first Asian NH Hotel

members only – exclusivity or community? • Hotel Designs